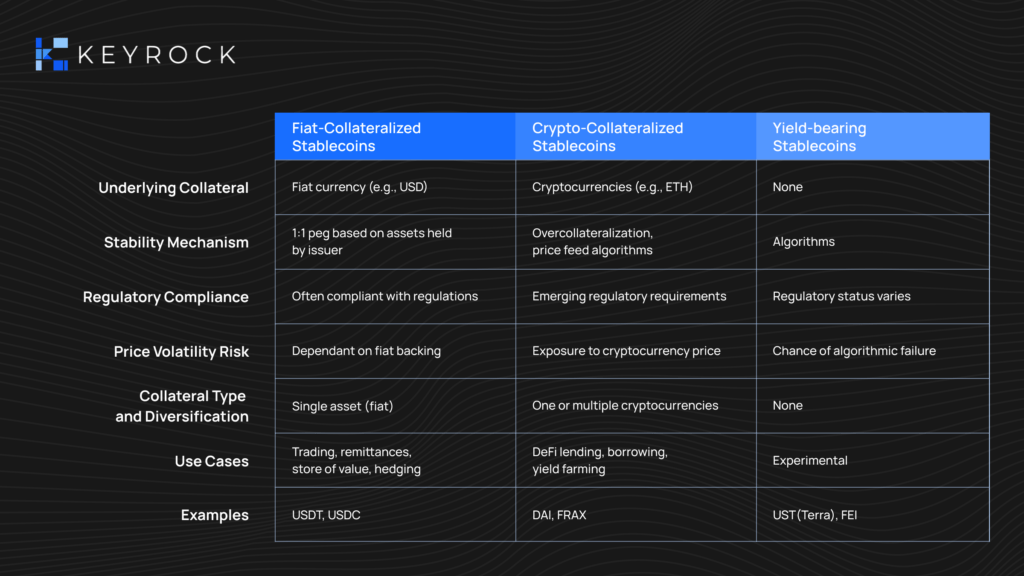

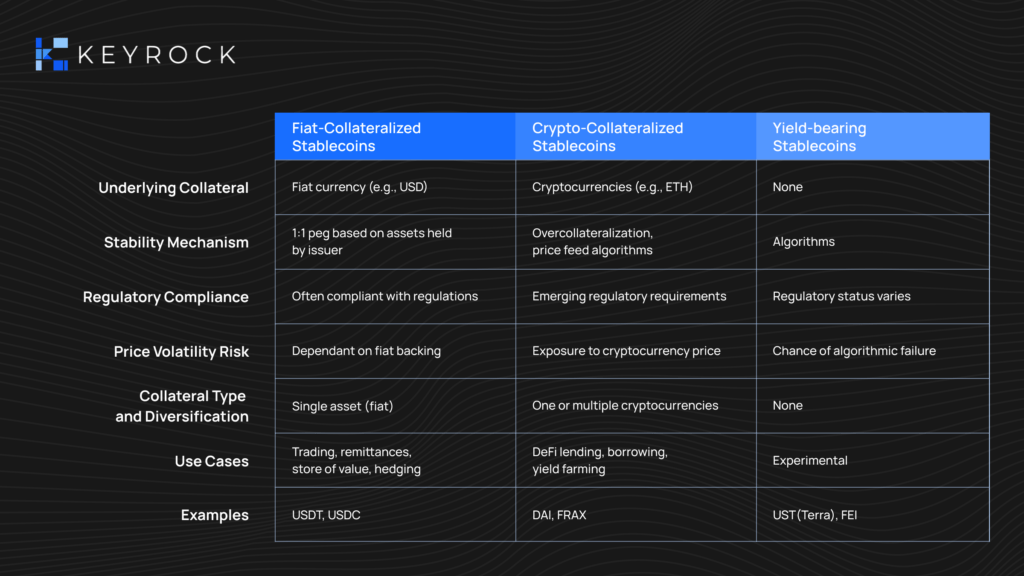

However, not all stablecoins are created equal, and the different approaches that exist for their implementation are the subject of debate. Understanding the difference between stablecoins is key to understanding their utility as well as their underlying risks.

Stablecoins can be broadly classified into three distinct categories depending on their mechanism for achieving price stability:

Fiat-collateralized stablecoins

This mechanism for maintaining price stability in stablecoins works as a simple IOU and has been the most widely adopted approach. It works by maintaining a 1:1 ratio between the digital asset’s supply and the amount of fiat held by the issuer.

Fiat-collateralized stablecoins like UDST and USDC are usually dominant in the market, especially in CEXes. They are referred by the market for their high liquidity and performance relative to other approaches.

Crypto-collateralized stablecoins

Similar to fiat-collateralized stablecoins, crypto-collateralized stablecoins also derive their value from being “backed” by a different asset — in this case, another cryptocurrency. Stablecoins like DAI and FRAX can be bought by staking another cryptocurrency like Bitcoin or Ether at a ratio higher than 1:1 to compensate for market volatility.

This mechanism makes them less popular than fiat-backed alternatives due to a need for over-collateralization and the risk of liquidation. However, since they can be issued programmatically by a protocol, they’ve become a popular source of liquidity for DeFi applications.

Yield-bearing stablecoins

There’s another approach to stablecoins that involves no collateral at all. This approach relies on algorithms that continuously adjust the supply of a stablecoin in order to maintain price stability and follow the price of an external asset.

Yield-bearing stablecoins have been seen as a promising development for crypto markets. This has been especially true for market participants who prefer an alternative to the reliance on third parties of fiat-backed stablecoins and the over-collateralization of crypto-backed stablecoins. However, failed attempts like Terra’s have left a bad impression on the market.

Comparison

Let’s compare these different types of stablecoins in terms of what they could mean for market makers: