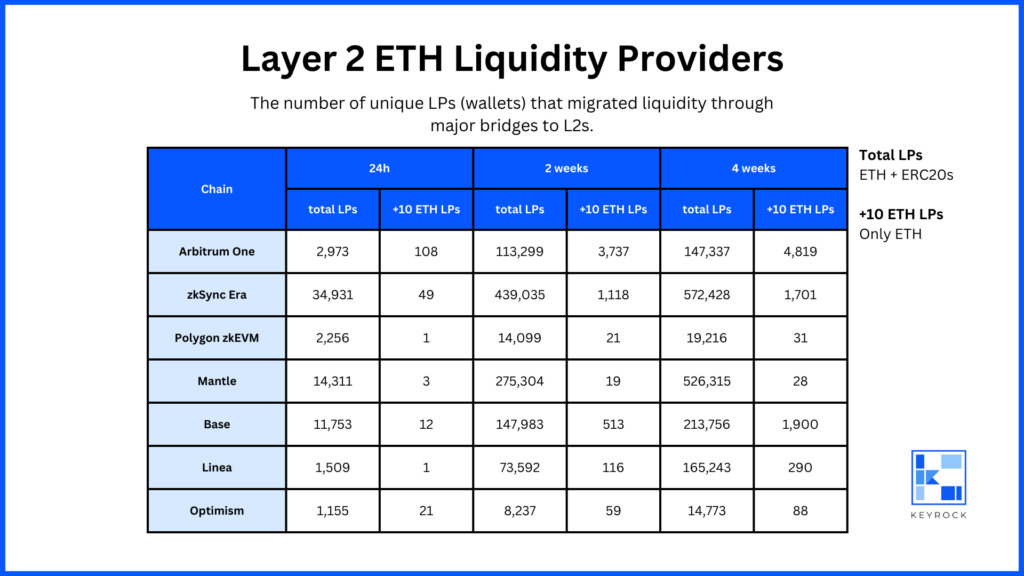

From observing just the number of LPs across each L2, we came to two general conclusions. First, Arbitrum stood out among other L2s in terms of ETH volume migrated and high-value LPs. Second, Mantle and zkSync Era stood out in terms of number of LPs, and Mantle stood out for its low number of high-value LPs.

We looked at more statistics to answer the question, how sophisticated are the LPs that migrated liquidity to each L2 in its earliest days? We answered this question by looking at the different cumulative activity of each wallet that provided liquidity to L2s in the first 24 hours after launch, as of November 24, 2023.

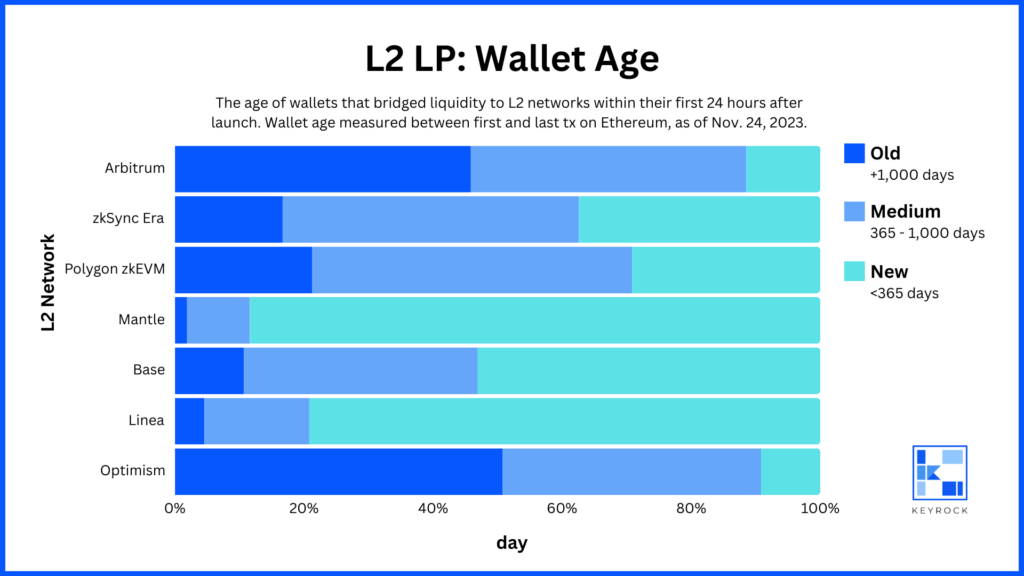

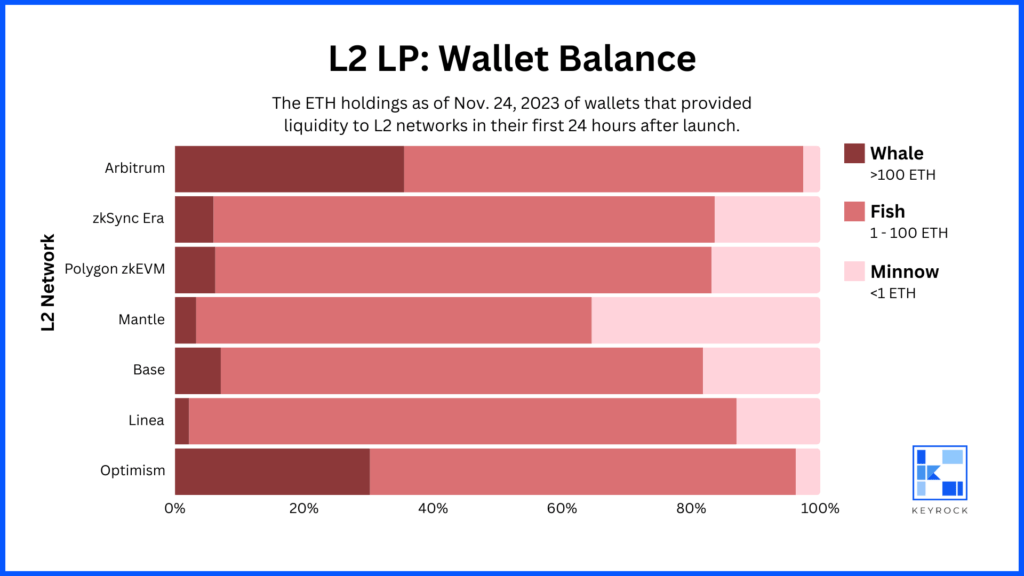

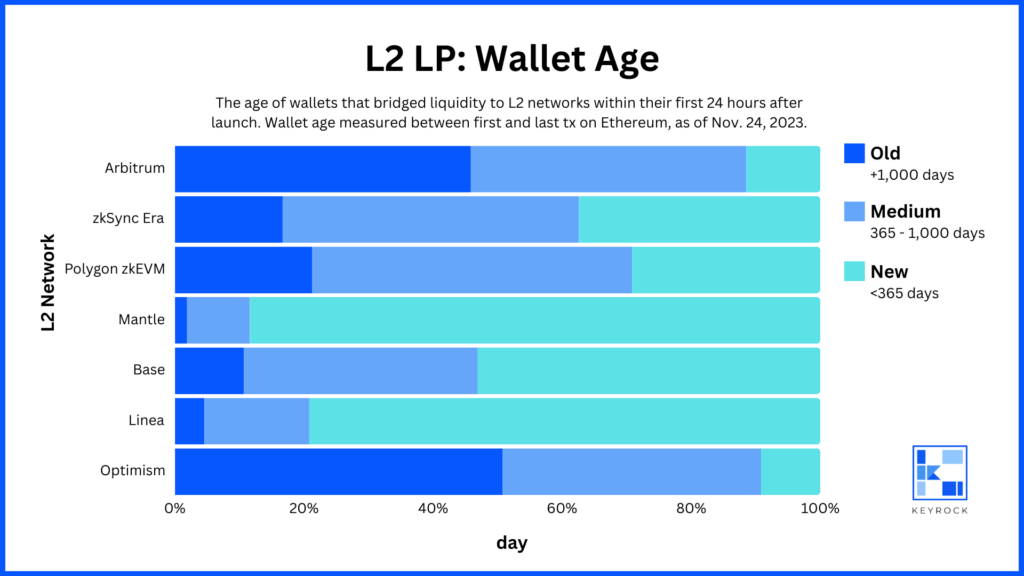

Wallet Age & Balance

Wallet age is measured as the length of time between its first and last transaction on Ethereum (as of Nov. 24, 2023). The wallets that migrated liquidity to Optimism and Arbitrum are the oldest since their first on-chain transaction was at the earliest the transaction that migrated liquidity to either network.

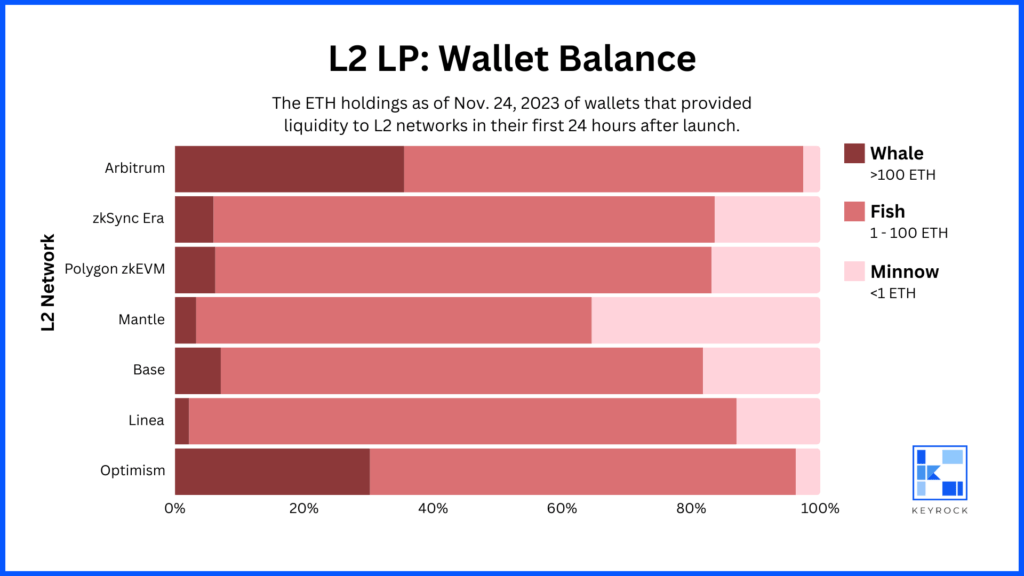

As of November 24, 2023, the wallets that LP’d to Optimism or Arbitrum had the highest per-wallet ETH balance among all L2s. Despite ETH prices at the time being at or above today’s prices (December 1, 2023), these wallets still have a higher ETH balance than those that were active in 2023 L2 launches. Likely, these wallets were either active before 2021 during the previous bear markets or remained active following the 2021 bear market and continued to acquire ETH over time — bolstering the emerging conclusion that Optimism and Arbitrum attracted the most sophisticated LPs.

Mantle again stands out on the lower end, with the highest number of young wallets and low-balance wallets. By looking at wallet age and balance, it becomes clear that the majority of Mantle LPs had only recently joined crypto, further bolstering our conclusion that airdrop hunting was a primary driver for these participants.

On-Chain Wallet Activity

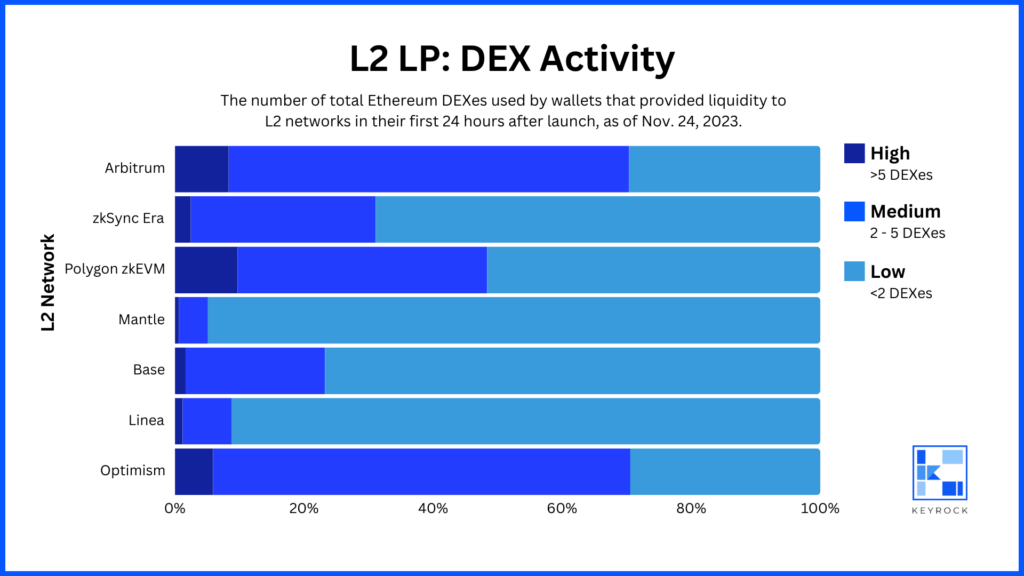

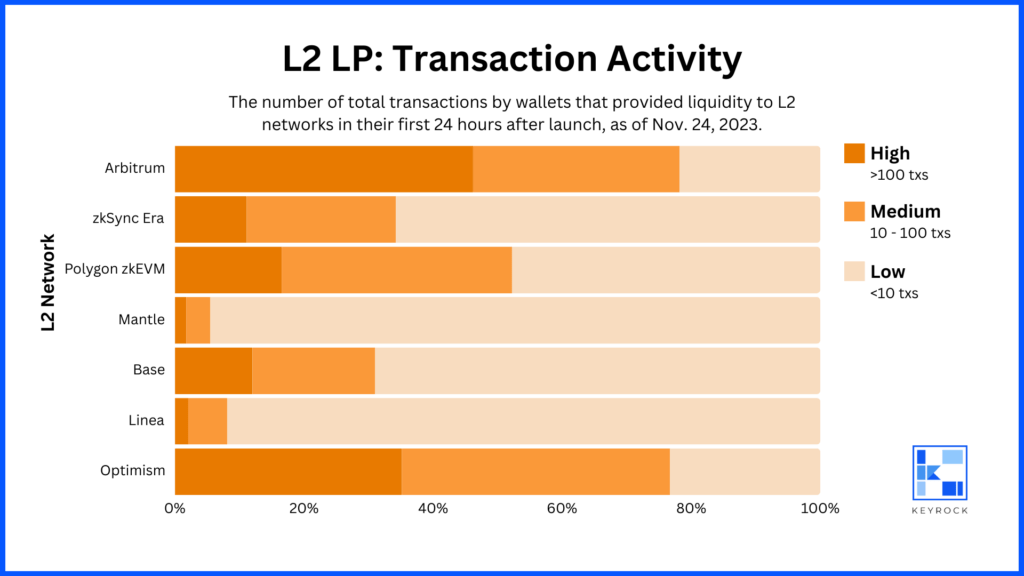

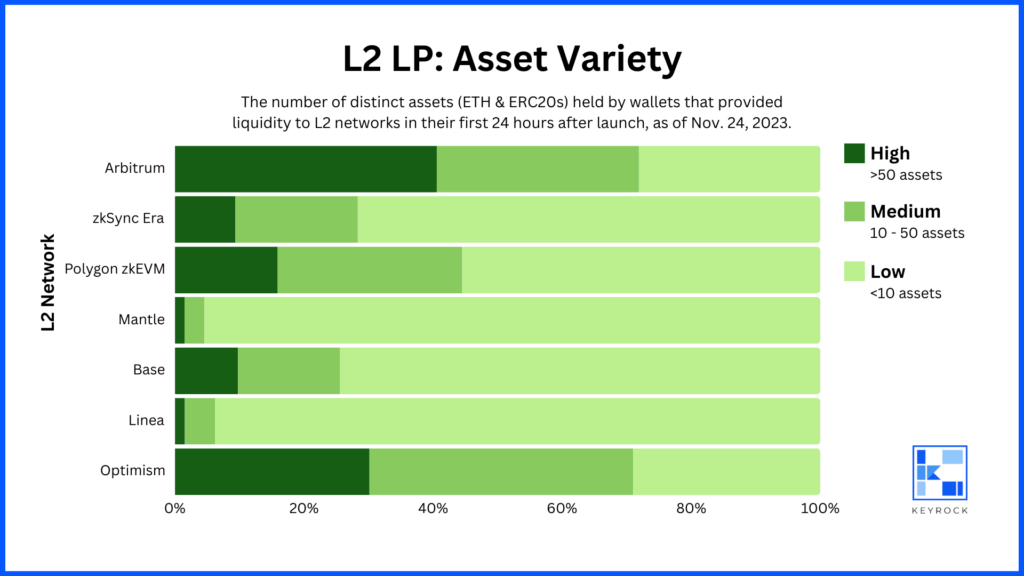

We looked deeper into each LP, drawing conclusions about the sophistication of each L2’s early LPs by looking at their other on-chain activity. Specifically, we looked at: transaction volume, DEX activity, and asset variety.

Our methodology was as follows. For each L2, we took all wallets that provided liquidity within the first 24 hours after launch. Then, we observed those wallets’ cumulative on-chain activity up to November 24, 2023.

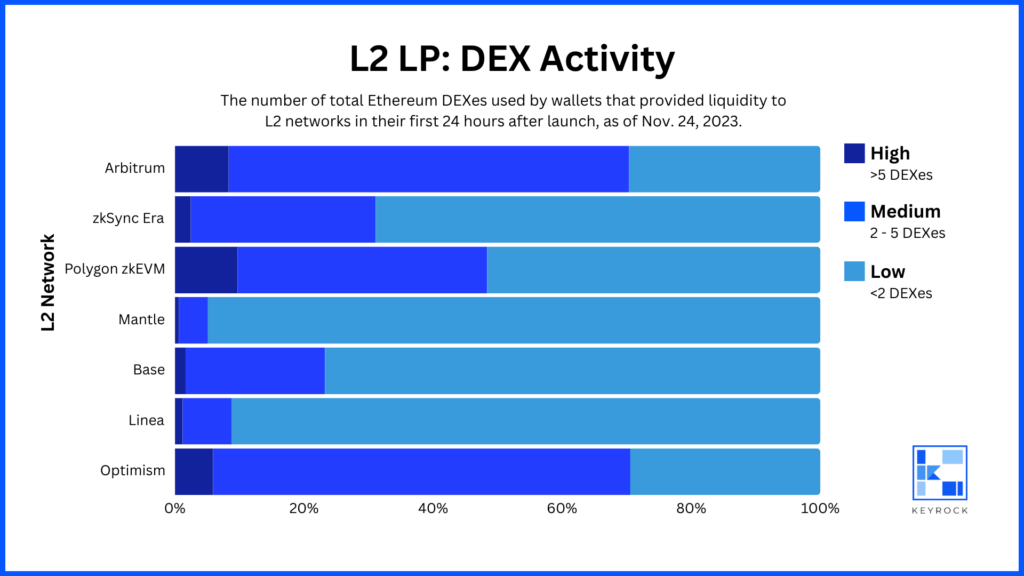

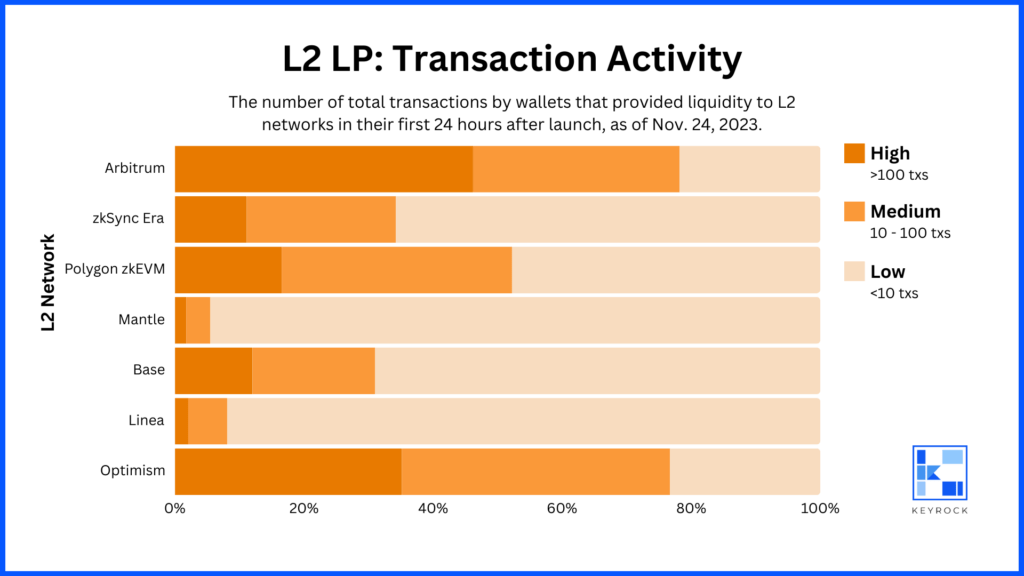

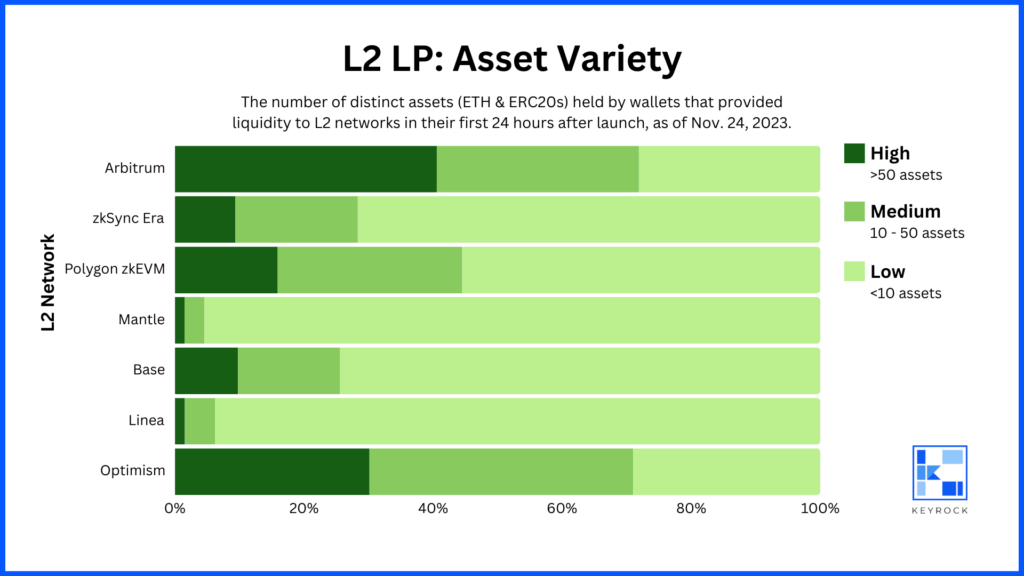

Again, Arbitrum and Optimism stand out as having the most sophisticated traders with the most diverse and high-volume on-chain history. 40-50% of early Optimism and Arbitrum LPs have made over 100 on-chain transactions, compared to <20% for every other L2. Similarly, over 70% of the early LPs of Optimism and Arbitrum hold over 50 unique assets in their wallets, compared to <50% of every other L2.

It was through on-chain wallet activity analysis that we further concluded the low sophistication of Linea, Mantle, and zkSync Era LPs. Linea and Mantle, in particular, were provided liquidity by wallets with comparatively low transaction volume, low DEX activity, and particularly low asset holding variety.

While looking further into asset variety, less than 5% of early Mantle LPs and less than 7% of early Linea LPs hold more than 10 unique assets today. Base is the third in line, with over 25% of early LPs holding more than 10 unique assets today. At the highest end, over 70% of early LPs of Arbitrum and Optimism hold more than 10 assets today.

Even among the 2023 launches, Mantle and Linea stand out in the low sophistication of their LPs. Less than 9% of Linea LPs and less than 6% of Mantle LPs have done more than 10 on-chain transactions. This is compared to other 2023 launches like zkSync Era (over 34%), Polygon (over 50%), and Base (over 30%).

The relative sophistication of Polygon zkEVM LPs was an unexpected conclusion from this LP behavior analysis. Across other statistics (number of LPs, number of +10 ETH LPs, wallet age, and wallet balance), Polygon was either average or below average. However, when looking at on-chain activity, we can see that Polygon zkEVM LPs were quite sophisticated.

In fact, among all 2023 L2 launches, Polygon’s LP behavior stands out. ~50% have interacted with more than 2 DEXes (compared to runner-up zkSync Era’s ~30%). Over 50% have made more than 10 on-chain transactions (compared to runner-up zkSync Era’s 34%). And 44% own more than 10 unique assets (compared to zkSync Era’s 28%). Because Polygon zkEVM launched from Polygon Labs, it’s safe to assume that a large number of the zkEVM LPs were already active in the Polygon ecosystem, so their wallets already had significant on-chain activity compared to other L2s.