Shifting Tides: Exploring the Flow of Funds from Ethereum to Non-EVM Chains

Three conclusions about the flow of funds from Ethereum to non-EVM blockchains from an observation of on-chain data.

Three conclusions about the flow of funds from Ethereum to non-EVM blockchains from an observation of on-chain data.

In the last few months, crypto has had new life breathed into it. Major price movements in late 2023 saw many assets reach their annual ATHs. In the United States, Bitcoin ETF rumors and false starts culminated in the spot BTC ETF officially launching in January 2024.

The Non-EVM blockchain ecosystem has had a significant impact over the last months— among them, well-known chains like Solana and Osmosis, as well as newcomers like Sui and Aptos. Like any other blockchain, non-EVM chains are tasked with attracting liquidity providers and their, well, liquidity.

These chains appear to be appealing options to users by offering them incentives, reduced gas prices, and new applications, compared to EVM blockchains and their challenges, such as network congestion leading to higher gas fees. In particular, non-EVM chains eye bridgers from well-established, high-liquidity ecosystems like Ethereum.

So, how successful have these non-EVM chains been in attracting liquidity from Ethereum, and what else can we learn from their behavior? We observed the migration of assets from Ethereum to multiple non-EVM chains over the last many months to answer.

We arrived at three major learnings:

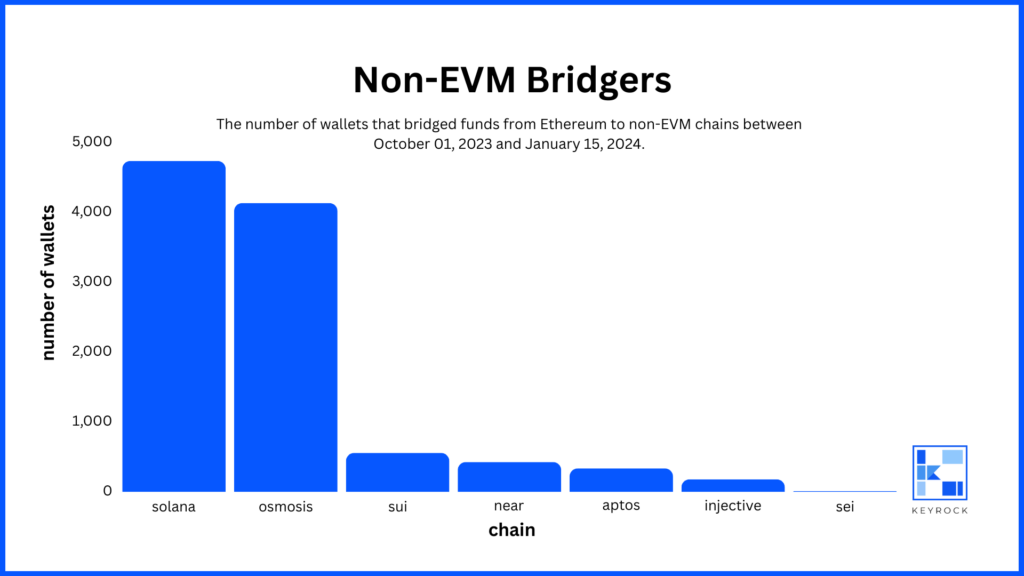

From early October 2023 to mid-January 2024, over 10,000 wallets bridged from Ethereum to one of the seven non-EVM chains depicted below.

When looking further into these wallets’ activity, more than 16,000 bridging transactions happened to Solana and Osmosis. This comes as no surprise since they’re the two most used non-EVM chains compared to the newcomers.

There is considerable experimentation in the non-EVM ecosystem, with impressive volumes of assets migrated out of Ethereum.

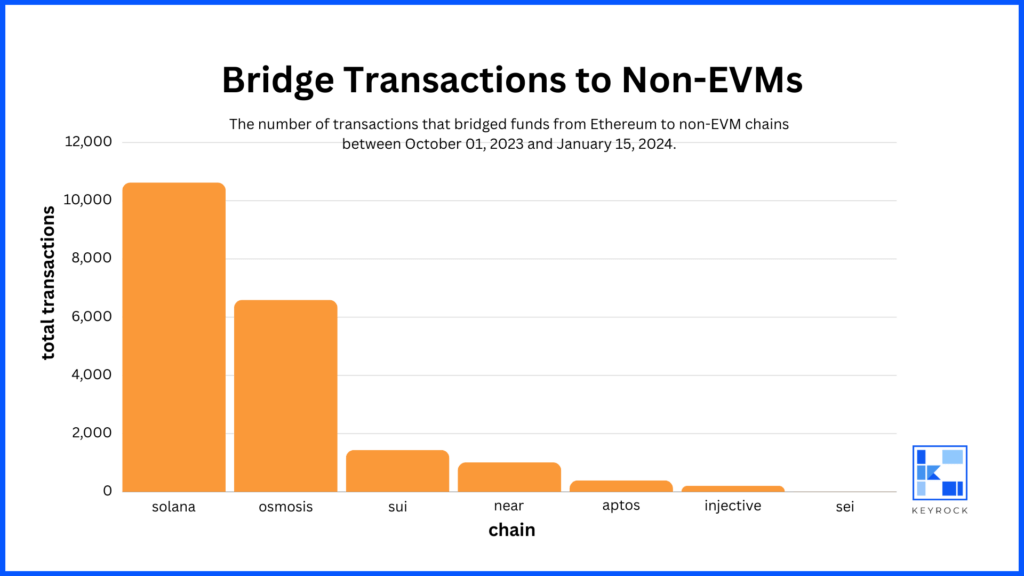

There is considerable experimentation in the non-EVM ecosystem, with impressive volumes of assets migrated out of Ethereum. Indeed, we observed Ethereum users executing nearly 18,000 transactions to move liquidity from Ethereum to a non-EVM chain in the 3.5 months analyzed.

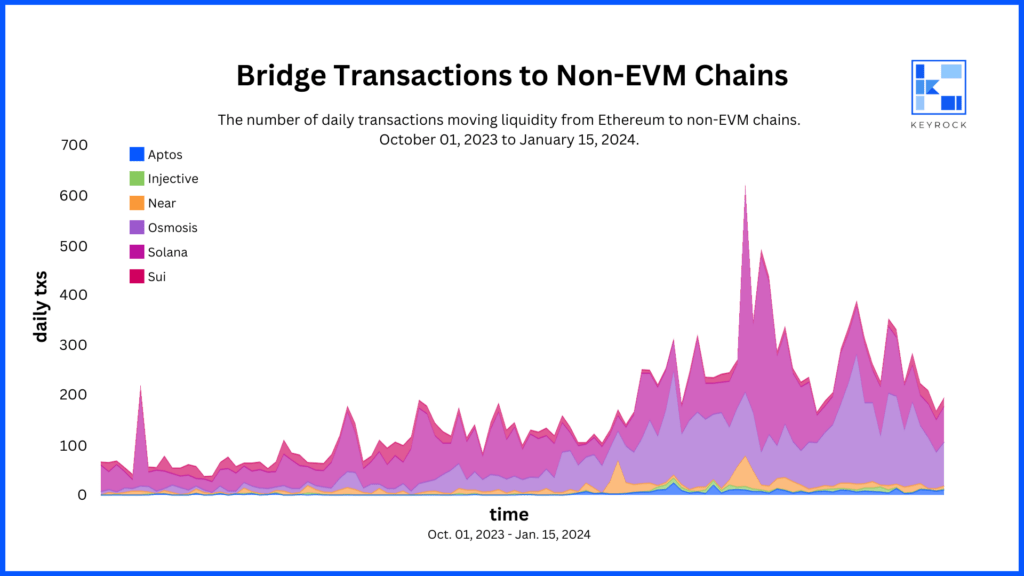

Ethereum to non-EVM migration transactions peaked during the third week of December, which was the height of the 2023 “mini bull market.” The day with the highest number of bridge transactions was December 21, 2023. Solana made up for the majority of those daily transactions just days before it reached its 2023 high of +$123 USD.

However, non-EVM experimentation was not confined just to that period of high-price action. Osmosis’ bridge transactions peaked in the first week of January. Sui was most active in early November. And Near hit the height of its bridge transactions within the first days of December.

From looking just at the narrative and hype around the price, it would appear that non-EVM chains had their biggest “moment” in late December. This presumption would seemingly be supported by highly visible networks like Solana. Yet, on chain data reveals that non-EVM interest was remarkably balanced throughout all of late 2023 and early 2024, regardless of price action. Migration from Ethereum to non-EVM chains fluctuated throughout the observed period across different chains, independent from price cycles.

Overall, we can see that interest in non-EVM chains was already strong well before the height of the market in late December, revealing a dedicated community interested in exploring non-EVM options.

There appears to be a pervasive wariness towards bridges and, thus, an appetite for more secure options.

Moving liquidity from Ethereum to non-EVM chains is a tech game requiring a high level of expertise, safety, transparency, and interoperability abilities, hence why bridges come into play.

As a result, bridges have risen as a critical solution, allowing eager crypto users to move their funds across multiple chains. However, they are not without their flaw since they have been the subjects of some of the most visible and severe hacks in crypto’s history.

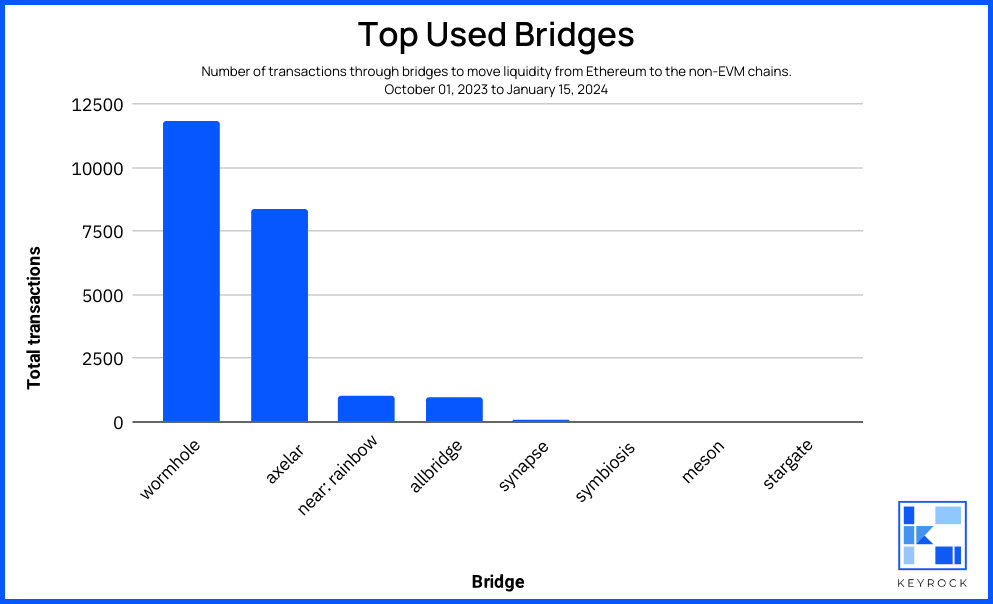

These precedents set the tone for many users who seemed to lean on a handful of bridges only. During the observed period, Wormhole and Axelar were the bridgers that accounted for over 90% of the transactions that moved liquidity from Ethereum to the non-EVM chains (+53% and +37%, respectively).

Moreover, only 232 (2%) interacted with more than 1 bridge out of the 10,300 wallets that migrated from Ethereum to a non-EVM chain. Such activity concentration between a few chains demonstrates a lack of cross-bridge experimentation, further solidifying our conclusion about users’ wariness toward bridges.

The typical user bridging from Ethereum to Non-EVM chains tends to be more seasoned and boasts a notably larger wallet balance.

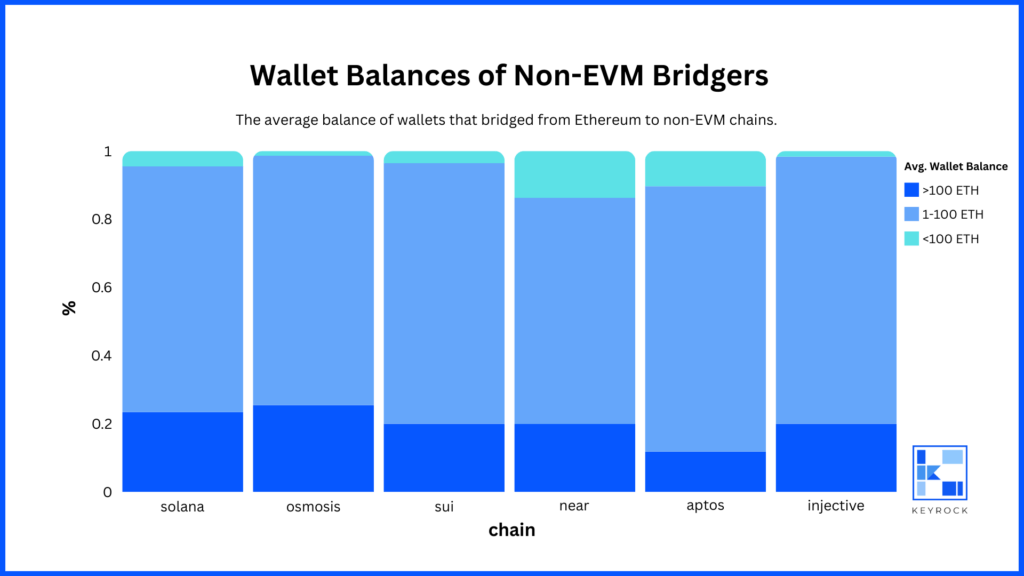

Though limited multi-bridge activity may suggest that many wallets were from novice users unfamiliar with on-chain crypto, further analysis reveals otherwise. For nearly every non-EVM chain, over 50% of the wallets were more than 365 days old (exception: Sui, with 49% of wallets).

Also, over 90% of the wallets on nearly every non-EVM chain held an average value of over 1 ETH (exception: wallets that migrated to Near, of which 86% had an average balance of +1 ETH). Additionally, over 10% of wallets that bridged to every non-EVM chain held an average of over 100 ETH.

The wallets that bridged to non-EVM chains between early October 2023 and mid-January 2024 were veteran, high-value on-chain crypto users. And yet, the overwhelming majority took a comparatively cautious approach to non-EVM bridges.

Overall, the non-EVM bridge ecosystem appears to be approached with considerable caution by the users moving funds from Ethereum. Perhaps aware of the many bridge hacks over the past years, these savvy investors are mitigating their risk by choosing only the best-known, most highly-capitalized bridges that theoretically have been stress-tested in the market.

Therefore, we can conclude that the wallets that bridged to non-EVM chains between early October 2023 and mid-January 2024 were veteran, high-value on-chain crypto users. And yet, the overwhelming majority took a comparatively cautious approach to non-EVM bridges.

This analysis showcases that the non-EVM bridge ecosystem appears to be cautiously approached by these seasoned users who are moving funds from Ethereum. Perhaps aware of the many bridge hacks over the past years, these savvy investors are mitigating their risk by choosing only the best-known, most highly-capitalized bridges that theoretically have been stress-tested in the market.

Recently, crypto has undergone a significant shift as prices have rebounded and major regulatory decisions have been made. Non-EVM blockchains, though they have certainly benefited from these developments, have also been steadily attracting bridgers and liquidity over the past many months despite market movements.

The trend shows us that non-EVM blockchains are resilient to market cycles and that the leading networks are attracting users from Ethereum for reasons that extend beyond just token prices — setting the stage for a vibrant multi-chain ecosystem. Something that we at Keyrock embrace and proactively support.

Besides this research, Keyrock has compiled a three-part blog post series about liquidity in layers 2. Here’s the scope of each one of them:

Stay on track with our liquidity research by following us on X and LinkedIn.